We’ve been here before. A new electricity-dependent technology arrives in New Zealand households. Initially only of interest to early adopters, it becomes rapidly popular as the economic advantages over incumbent technologies dawn on consumers. As it infiltrates more homes, however, concerns mount over the impact on the electricity grid, particularly during the early evening period of peak demand. What if this new load keeps growing, and the distribution infrastructure starts to creak? How are we going to keep the lights on?

The radical new innovation was the heat pump, and as we know, the sky didn’t fall, while homes were made warmer, faster, for less cost. But now similar questions are being raised about another game-changing technology: the electric vehicle. And in this instance, the heat pump analogy isn’t necessarily comforting, because while the former has tended to replace existing forms of electric heating, EV charging represents a brand new demand arriving in the home.

“Will electric cars break the grid?” was the headline of one recent article in an overseas journal, and while it may overstate the concern, New Zealand electricity providers need to get to grips with the issue. What exactly is the challenge to the grid posed by rising EV uptake? Where are the potential pinch points? And what are the solutions?

Some context. The government’s Electric Vehicle Programme, announced in May 2016, sets a target of doubling the number of EVs on our roads every year, to reach 64,000 by 2021 – or two per cent of the national fleet. While public DC fast-charging stations are being rolled out around the country, it’s anticipated that the vast bulk of charging will be “low and slow” and done at home, using a wall socket in the garage or a dedicated EV charging unit.

Let’s be clear, this dawning electric age is a good thing for all concerned, not least the environment. For the consumer, transitioning to an electric vehicle means handsome savings on their weekly ‘fuel’ bill. Meanwhile, New Zealand’s 29 lines companies get to run more power into the country’s households, and the 20-odd electricity retailers in the market get to sell more electrons.

“The big advantage is that every time you plug your EV in, we’re earning money,” says Northpower Network Engineering Manager Russell Watson. “If I earn some more revenue because people are using my network more, provided the issues are smaller, then I’m winning.”

What’s more, there’s no risk of the country running short of power, even in the most extreme scenarios involving rapid EV uptake.

But, for some, there is a genuine concern about how the uptake of EVs might stress the energy networks that delivers power into our homes.

“Electric vehicles have the potential to significantly increase a residential consumer’s peak,” says Eric Pellicer of Powerco, a New Plymouth-based utility that supplies electricity and gas to more than 430,000 homes and business in the North Island.

A hot water cylinder, which is one of the largest loads in most kiwi homes, draws two to three kilowatts at peak, he notes. In comparison, an EV charger might draw as much as seven kilowatts, or potentially even more.

“And if you’ve got a 32 amp power plug or a fast-charger in your garage, you could effectively double or triple your peak energy usage,” says Pellicer. “Networks are not designed with excessve headroom because that would be uneconomical for consumers. They have mainly been built to deliver what we think will be needed in 10, 15, 20 years time. But electric vehicles could completely change the mix in potentially a much shorter timeframe. That’s the challenge.”

WHAT IS ELECTRICITY DISTRIBUTION, AND HOW DOES IT WORK IN NEW ZEALAND?

When we talk about the distribution network, we are talking about the lines that delivers power from the transmission exit point (the large substations built by Transpower) through to a customer’s meter board – so poles and wires, transformers, sub-stations and all the other associated infrastructure. Distribution networks are not built on how much energy goes through them over time (i.e, the volume), but rather on the basis of capacity – the peak power that has to be delivered at any moment.

Lines companies are closely focused on the latter – in particular, on capacity when the network experiences its highest use, during the morning and early evening peaks, when people arrive home, flick on the heating and start cooking dinner and bathing children.

How do networks develop? Largely, by incremental growth, driven by an expanding population, new businesses, energy efficiency developments, and so on. The cost for building these expansions is generally recovered over many years, from all customers in the electricity bills we pay.

As well, there’s always an element of what the industry calls ‘wholesale’ growth, which is what occurs when a property developer unveils a new subdivision, or a dairy company builds a large factory. In those cases, the incremental costs associated with that customer load are, in most cases, recovered from the customer directly.

Roughly a third of every dollar on a customer’s power bill represents the cost of delivering electricity to their home, with another third going on generation, and the rest on metering and retailing costs, plus a little margin. In other words, the distribution industry recoups its investment in the network from that 30-odd cents per dollar, and it does it by way of the retailer, which has the sole relationship with the consumer.

Given the diverse motivations of the players, that arrangement can pose a real test to the grid, says Pellicer.

“Unless there is collaboration between the distributor and the retailers, then the capacity versus volume question doesn’t get truly addressed. There is a lot of opportunity for innovation in this space.”

Into this mix comes the electric vehicle.

HOW DO ELECTRIC VEHICLES CHALLENGE THE GRID?

The development of electric vehicle technology is heading in only one direction – towards cars of greater range, and high-powered and faster charging. In some overseas territories, the advent of 300kW charging stations is already under way.

But even in the case of a household using a basic AC charger, an electric vehicle could add significantly to that home’s energy peak demand. That’s known as an infill challenge, and it’s a sharp test for any distribution business, according to Pellicer.

“Rapid infill in demand is not the same as ‘green-fields’ new connections,” he says. “In this case, they’re saying ‘I want to add the equivalent of at least an additional hot water cylinder to my home’. So you have the same number of customers effectively using more power, and that demand can jump relatively quickly.

“In the local ‘node’ concept of the network, a few houses potentially doubling their evening peak can create material impacts on the local infrastructure and drive a need for investment.”

If every EV owner were to charge at different times of the day, staggering the impact on the grid, there’d be little to worry about. But particularly in this early phase of EV adoption, when public charging capacity is patchy and new owners are wrestling with range anxiety, it’s more likely people will charge when they get home during the evening peak, and charge fully – especially if the true cost of that behaviour is not reflected in the tariff.

“If we do nothing, that will be the outcome,” suggests Wellington Electricity CEO Greg Skelton. “People will drive home and plug in their vehicles, and just wander off.”

The new demand created by EV charging also threatens the traditional pattern of incremental growth. As Pellicer puts it, “if everyone could go out tomorrow and buy an EV you’d have no control over that. If they install an EV charger in the garage, you have no control there, either, and all of a sudden they could be doubling their peak – and their neighbours could be doing the same.”

Is that scenario likely? Most predictions are that mass EV penetration in New Zealand will take many years, and even the government’s 64,000 target equates to only a small fraction of the national fleet.

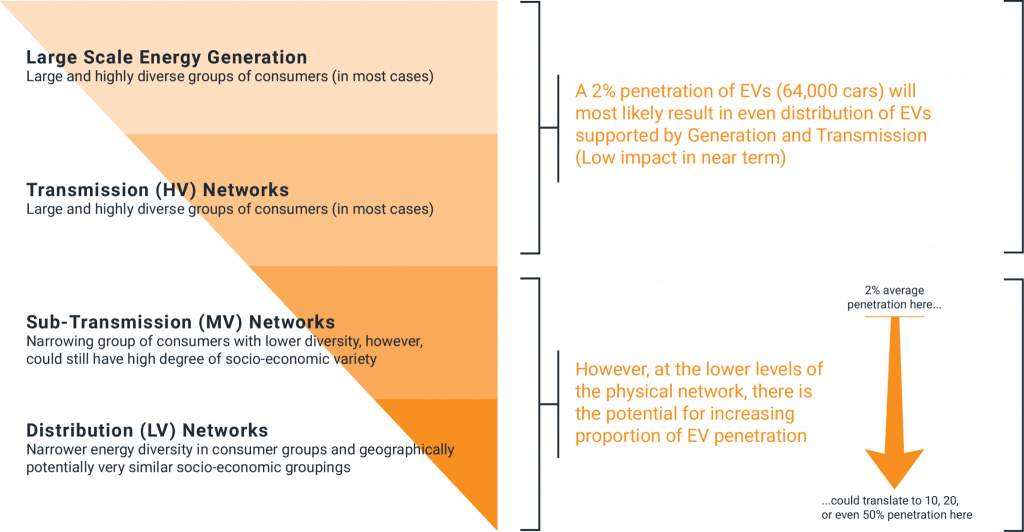

However, no one really knows where these EVs will end up and which areas of the grid could be stressed. (One suggestion to create greater transparency is for new EV owners to be encouraged to register chargers with their power provider.) Common sense suggests they will be concentrated in the cities, and heaviest in particular urban neighbourhoods.

Pellicer cites the example of some fast-growing areas of the network, whose population are in a position to invest in EVs. He predicts that some will adopt EVs quicker than the norm and envisages some places hitting 20 per cent penetration, with a number of households choosing to install dedicated high-powered charging units.

“The fate of AVs and EVs will only grow more intertwined in the coming decade.”

That clustering effect has to be kept in mind when considering any predictions of the effect of EVs on the grid.

Take Meridian Energy’s report “New Zealand Electric Vehicle Load Potential”, for example. Released earlier this year, it considers fleet and travel data, EV charging profiles and uptake rates to forecast impacts on the peak. Assuming half of all new vehicles to be electric by 2046, it concludes that in 30 years the peak would be 13 per cent higher under a “dumb” charging scenario. If charging were “semi-smart”, however, the peak would be just six per cent higher.

But Meridian’s Neal Barclay points out that this is an analysis based on averages, and so very likely understates the localised effects. “When you get down to individual networks, the impact on peak capacity can be more acute.”

And what about that ongoing development of fast-charging technology, hinted at above?

“It’s really challenging,” says Powerco’s Dan Gnoth. “We don’t know how fast the EV market is going to grow, nor how the capabilities of these vehicles are going to develop. When we put something out in the field, usually our payback period is 50 years. But can we keep that model going as the requirement for this type of technology changes maybe five times in the next 50 years?”

Another, somewhat contradictory challenge posed by electric vehicles is their mobility. Normally, if a customer wants to connect a new business to the network the lines company knows exactly where that new load will come on.

“But an electric vehicle moves around the network. You’ve got something you would expect to be over here, and it’s over there charging instead,” says Pellicer, who adds that in this instance the issue is not so much about EVs stressing capacity, but potential under-utilisation of other parts of the network that have been strengthened to cope with expected charging patterns.

In both cases, the common theme is a lack of transparency about where new EVs will be located, and general uncertainty about the numbers. Lines companies can make educated guesses, but they can’t know for sure which parts of the network will be stressed, and to what degree.

“The network has very little visibility on what is actually happening on the customer side of the network. Let’s say there are 50 houses downstream of a particular transformer; while we have sized the capacity there for what we have traditionally come to expect, we don’t know exactly what is happening now or in the near future, and we depend very heavily on customers’ feedback.”

As a result, utilities may end up responding to weaknesses in the grid only as problems arise, having to make reactive rather than proactive investments in new infrastructure. That’s a problem, because investment made on the back foot always costs more, and invariably inflate lines charges.

“So we need to make sure investment is prudent, just-in-time and meets the longer term needs of the consumer base.”

But how do you do that?

THE GLOBAL PICTURE

If anything, the impact of EV charging on the residential peak threatens to be even sharper in this country, given the comparatively high proportion of New Zealand homes with off-street parking. So what steps should we be taking? How can EV owners be encouraged to charge outside of peak?

Currently, the market mostly uses flat electricity tariffs that give no signal to residential customers about when demand is reaching peak, or conversely when there’s slack in the system. Most of us switch on our appliances in blissful ignorance of the network ramifications.

“What probably isn’t being realised yet is the need for some education to go with the purchase of an electric vehicle,” remarks Greg Skelton, who says that Wellington Electricity is talking to motor vehicle dealers about the issue.

Education only takes you so far, however. The key to influencing behaviour lies with cost-reflective pricing, a development that’s now being pushed by the Electricity Authority.

“There’s the easy one, the stick, where if you charge in a high demand period you’ll pay a high price,” says Skelton, “or there’s the carrot: ‘Listen, there’s a period outside that peak where it’s cheaper to charge’.”

But electricity tariffs can be tricky instruments, with potential for being both unfair and ineffective. Skelton says Wellington Electricity is about to launch a trial of 100-odd EV owners, the first step in a wider process of changing how its pricing is made up. “The idea is to use that sample set of people to say, ‘How would you respond to cost-reflective pricing?’”

“It’s easy to say, but hard to do in practice,” comments Meridian’s Retail General Manager Neal Barclay of cost-reflective pricing.

He points out that some retailers are already trialling EV tariffs. Meridian, for example, provides cheaper rates between 9pm and 7am in the main metro areas of Auckland, Wellington and Christchurch.

LOOKING FOR HOME-GROWN SOLUTIONS

If anything, the impact of EV charging on the residential peak threatens to be even sharper in this country, given the comparatively high proportion of New Zealand homes with off-street parking. So what steps should we be taking? How can EV owners be encouraged to charge outside of peak?

Currently, the market mostly uses flat electricity tariffs that give no signal to residential customers about when demand is reaching peak, or conversely when there’s slack in the system. Most of us switch on our appliances in blissful ignorance of the network ramifications.

“What probably isn’t being realised yet is the need for some education to go with the purchase of an electric vehicle,” remarks Greg Skelton, who says that Wellington Electricity is talking to motor vehicle dealers about the issue.

Education only takes you so far, however. The key to influencing behaviour lies with cost-reflective pricing, a development that’s now being pushed by the Electricity Authority.

“There’s the easy one, the stick, where if you charge in a high demand period you’ll pay a high price,” says Skelton, “or there’s the carrot: ‘Listen, there’s a period outside that peak where it’s cheaper to charge’.”

But electricity tariffs can be tricky instruments, with potential for being both unfair and ineffective. Skelton says Wellington Electricity is about to launch a trial of 100-odd EV owners, the first step in a wider process of changing how its pricing is made up. “The idea is to use that sample set of people to say, ‘How would you respond to cost-reflective pricing?’”

“It’s easy to say, but hard to do in practice,” comments Meridian’s Retail General Manager Neal Barclay of cost-reflective pricing.

He points out that some retailers are already trialling EV tariffs. Meridian, for example, provides cheaper rates between 9pm and 7am in the main metro areas of Auckland, Wellington and Christchurch.

Charging outside of peak represents a good load spreading opportunity, but will it create a secondary peak?

How effective such ‘carrots’ are in practice depends on the attractiveness of the price difference between peak and off-peak, and much of that depends on the signals provided by lines companies, says Barclay. In Meridian’s case, the cheapest overnight rate it offers is the equivalent of 20 cents per litre in Wellington, while the most expensive is 30 cents in Auckland.He’s a firm believer in the importance of cost-reflective pricing, not least for fairness reasons. EV owners will be driving more cost into the network, he points out. “If cost reflective pricing is not put in place, then that cost gets smeared across the whole customer base. People who aren’t early adopters effectively pay for early adopter activity – that’s if we get it wrong.”

A potential complication is the differing motivations of the various players in the market. Lines companies can try to influence consumer behaviour with a more cost reflective Time of Use tariff, for example, but it will prove toothless if retailers don’t pass on the signal.

“The retail market is very competitive,” says Skelton, “and the last thing they want to do is have a difference in price signal that to their customers makes them look .”

Barclay is not so sure about that, and predicts that if lines companies structure their pricing to be cost reflective, retailers will follow.

Even so, the sheer diversity of the market, with a plethora of distributors and retailers, all operating under different commercial structures, creates some uncertainty about how all this will pan out.

“To manage this effectively across the country, there’s going to have to be a degree of standardisation and cooperation,” says Barclay.

Skelton, too, stresses the need for cooperation. “You see it around the rest of the world: there are ways of providing services with distributors and retailers working together. We have to line up the vehicle owners, and bring retailers along on the journey.”

How would a tariff be structured to meaningfully effect EV charging? Eric Pellicer begins by stressing the importance of being technology agnostic.

“Technology-centric tariffs, such as a specific network tariff for EVs, aren’t necessarily the right answer,” he argues. “We shouldn’t care if we’re talking about a fridge, or a car, or whatever – if it drives a peak, then it drives an incremental cost, and we have to recover that cost. Instead, we should consider tarrifs that reflect the true challenges introduced on the network by that load, which a retailer can then turn into an EV charging package – hopefully to optimise a customer’s charge service.”

“It needs to be simple for customers to engage without actively having to run around,” he continues. “For example, ‘I want a $10 per week charge plan for my car that means I’ll always have 40 per cent in the tank’. Or, ‘I want a $20 package that means I’ll always have 80 per cent’, and so on.”

Northpower’s Russell Watson is optimistic this won’t prove so difficult. Watson has owned an EV for three years, and routinely takes advantage of a tariff offered by Mercury that saves him 20 per cent to charge at night.

“If you just want to boil the jug, it’s not worth it, but an electric car is one item where there is a real incentive,” he says. “And it’s not that inconvenient for me to plug in later.”

Yet there is potentially a large fishhook in using price signals to shift EV charging behaviour. Overseas, there’s been evidence that, in some circumstances, TOU tariffs can produce a secondary peak, as everyone starts charging in the late evening when the cheaper rates kick in.

A recent trial by Powerco, while far too small-scale to be conclusive, gave some weight to the theory.

“If we try to have control over EV chargers and move charging to later, low-use periods, we may be creating a new peak as big if not bigger than what we’ve already got,” suggests Powerco research and development analyst Elizabeth Chisholm. “So, you can’t just think of it as a block of moveable electricity use. You have to be smarter about how to control that big chunk of charging time.”

In other words, the use of tariffs will have to go hand-in-hand with clever and effective forms of demand-side management – the kind that may require EV owners to cede an element of control.

“We need to have smart infrastructure that allows the dialing down of charging, the stopping of charging, the over-riding of charging and the control of charging – all with the customer’s blessing, of course,” says Powerco Customer Works Manager Mike Hay. “That’s going to be the crunch to managing the uptake of EVs and the impacts on the network.”

But how will it be tackled? And will EV owners be prepared to play ball?

INNOVATIONS AND OBLIGATIONS

There’s a well-established precedent here – ripple control. Since the 1960s, New Zealand lines companies have been able to switch off hot water cylinders in the home during ‘rush hour’, for which customers are rewarded with savings on their bill.

Obviously, there’s a significant difference between taking a punt on the occasional cold shower and okaying an arrangement that could leave you without enough battery charge to travel.

“The industry is already set up to allow distributors to control load in consumers’ homes,” says Pellicer. “The barrier here is people’s perceptions of what they would be losing for the value gained. What if I can’t drive to the grocery store? Or the airport? Or the hospital? That’s a lot more serious than a cold shower.”

Powerco’s trial, he says, has uncovered a distinct ‘full tank’ mentality among EV owners, strongly correlated to range anxiety. “People will be very hesitant to hand over control.”

The answer, he says, could lie in using meaningful price incentives yoked to smart charging and smart-grid technology.

Imagine that a charger is moving towards saying ‘I can measure how much charge you’ve got left in your battery, and based on how you’ve used your car in the last couple of months, averaging 40 kilometres a day, I’ll charge your battery up to that point, and then I’ll back it off’. That is smart-led control, and that’s where we want to get to, so consumers don’t feel disadvantaged by it, but will still get all the benefits.”

Much of this is technically possible right now. For Powerco’s residential trial, for example, the participant was given a JuicePoint smart charger, and the trial unfolded in three phases: basic uncontrolled charging; time-set charging, with the ability to use the JuicePoint app to override Powerco’s scheduled charge times; and a final phase, in which the over-ride option was retained, but the participant was given up-to-the-moment information about the cost of using it.

In this instance, the full-tank mentality proved overwhelming, and the over-ride function was used regularly. But this was a first-time EV user, and the expectation is that, as EV ownership becomes more commonplace and public charging infrastructure widespread, range anxiety will ease.

Pellicer also anticipates there will be a useful diversity of motivations among EV users. “There will be people who will want fast charging and to 100 per cent, and at the other end of the spectrum, there’ll be some very price-conscious customers who are happy they’re not paying $100 at the pump every week and will be looking for optimum savings.”

The challenge is to find a pricing sweet spot. As Mike Hay puts it, “all of this needs to go hand-in-hand with a retail package that really incentivizes those customers to give up having total control. As a lines business, we’re not only working with technology developers, but also with retailers to see how this sort of thing can be packaged and sold to a customer base.”

It will also be important to provide customers with flexibility and up-to-the-minute data.

“We really want to start using price signals that truly reflect the cost of when to charge, so customers have a choice, or they can leverage the control system in the vehicle to start to make that decision,” says Wellington Electricity’s Skelton.

“Over time that’s where control systems will go: they’ll be looking at a signal we post on our internet, and the vehicle will say, ‘Let’s look at WE’s line charge profile for this evening. Looks like we’ve got congestion in these hours, and it’s cheaper after this hour and, by the way, out of 20 retailers, which one do I want to book into that has a cheaper energy rate that I can match with that lower charging rate on the network?’ That’s where we start to see options for the consumer to exercise some of their own controls – and also to automate those controls, to ‘set and forget’.”

All of this is entirely possible, adds Pellicer. “But what is missing at the moment is the back office integration with what’s happening on the grid. The current process is very manual – as a lines company, we effectively publish when we think we’re going to have a peak.”

It’s a blunt instrument, in other words, and it misses what’s happening in real time at the local level.

“Nirvana would be if a charger had the ability to work with systems that could predict in advance what the peak will be on the network in the next period and then make optimal use of that information. However, back in the real world, even information on the current load conditions will be a big positive step forward. Many distribution transformers currently have no monitoring and intelligence on them. But if they did, that intelligence would be able to tell you how much load was currently at that node on the network, and then it could speak to all the EV chargers around that area and say, ‘Hey, there’s actually plenty of headroom right now, so don’t worry about that load control period, just continue to charge’. That’s a really exciting place we could get to.”

TURNING THE PROBLEM ON ITS HEAD

The discussion so far assumes that rising EV uptake will be a challenge to the grid. But it’s entirely feasible that electric vehicles could also be harnessed to actually enhance network stability, operating as mobile batteries feeding power back into the grid at times of peak demand.

Utility regulators in California, for instance, are looking at EV batteries as a “fast acting resource” to respond to increasingly sharp late afternoon demand spikes. (Alternative answers, such as drawing on natural gas peaker plants, could impede the state’s targets to reduce greenhouse gas emissions.)A white paper from the California Public Utilities Commission suggests that, if integrated into the transmission-distribution system, EVs would reduce costs for grid operators.

Those savings could be passed on to EV owners, promoting yet more EV uptake – a virtuous circle.

In New Zealand, meanwhile, the Electricity Authority has recognised the possibility of an EV-to-grid future, classifying electric vehicles as a distributed energy resource.“What that says to us is that, in their mind, the authorities are already preparing for someone plugging in their car and allowing it to provide grid support,” says Pellicer. “It’s a realistic idea that they’re beginning to cater for.”Last year, Nissan announced plans for a major vehicle-to-grid trial in the UK, involving the installation of 100 V2G units to enable private and fleet owners of Nissan LEAFs and e-NV200 electric vans to sell energy back to the grid.

In an eyecatching publicity display, the Japanese manufacturer also powered a small concert in the US using a LEAF battery pack.Of course, it’s early days. Not all current EVs have bi-directional chargers, and there are various other hurdles at the garage end of the equation. Larger wall-mounted chargers would certainly be required to allow an EV battery to participate in the energy market, and there’d be infrastructural and technological changes needed at the grid end.

But there’s every prospect of electric cars one day being used to offset a home’s load. And if you could aggregate all those EVs out there and turn them into megawatts of power, it could become a significant grid resource, says Pellicer.When you start to consider that EV technology is heading in the direction of batteries of 500kw, he says, “then you are no longer talking about just providing support to a single home. That car can now effectively support three, four, five homes down the street.

If you have a street with 20 homes, and 10 per cent have these types of EVs in the driveway, all of a sudden that entire street can be supported during peak times by those few cars.”It’s an exciting scenario, and a heartening one for lines companies anxious to see the EV revolution succeed without risking collateral damage to the grid.“On the whole, electric vehicles represent an incredible opportunity for the industry, and a huge benefit for New Zealanders,” says Pellicer. “If we take advantage through greater collaboration, we’ll create a win-win scenario, and solve some new challenges along the way.”

Matt Philp – Author

Matt Philp began his feature writing career at the New Zealand Listener, and was a senior writer for Metro, The Press and North & South. Now a freelancer, he writes on architecture, lifestyle, business, heritage and travel for several New Zealand magazines.